Question 2

The table below shows the incomes and rates of income tax levied on four professionals in an economy.

Profession |

Income per month ($) |

Tax rate (%) |

Disposable income ($) |

Doctor Engineer Civil servant Nurse |

8,000 7,000 5,000 6,000 |

10 12 18 15 |

|

Use the above data to answer the questions that follow:

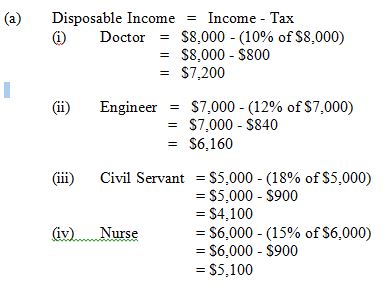

(a) Calculate the disposable incomes of the four individuals.

(b) What system of taxation was employed?

(c) Give reasons for your answer in 2(b).

(d) With the aid of a diagram, explain the system of taxation employed in 2 (b)

Observation

This is the alternative data response to question (1) and was very popular with the candidates. The question required candidates to calculate the disposable incomes of four professionals in an economy, determine the system of taxation employed and explain with the aid of a diagram the system of taxation employed. Most of the candidates could calculate the percentages for the various incomes but did not deduct the values obtained from the gross incomes to obtain the disposable income and some candidates could not explain the system of taxation employed.This made them to score average marks.

The candidates were expected to provide the following answers to obtain the maximum mark.