Section B

Question 7

Answer question three questions only from this section.

(a) What is reorder quantity?

(b) Explain what is meant by:

(i) FIFO;

(ii) LIFO.

(c) An auto parts merchant purchased auto parts at different prices in

2018, as shown below.

Month |

Quantity Purchased |

Unit Price (N) |

February |

1,500 |

10 |

March |

1,000 |

15 |

April |

2,000 |

12 |

May |

500 |

15 |

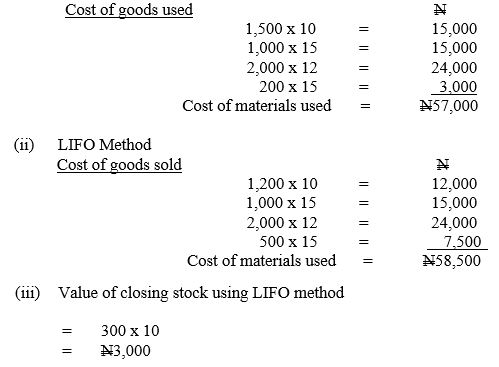

If 4,700 units were used during the year, calculate the cost of materials used, by:

- FIFO method;

- LIFO method.

- What is the value of the closing stock, using LIFO method?

Observation

Most of the candidates avoided this question. Here is its solution.

(a) Re-order quantity is the required quantity of stock at which new order are placed to replenish the supply before stock falls below minimum.

(b)(i) FIFO: is a stock valuation method or method of valuing inventory which assumes that the first goods purchased are the first goods used up during an accounting period. It means first in, first out. i.e. first batch of materials that come into store should be issued to production before the second batch.

(ii) LIFO: means last in, first out. It is the opposite of FIFO. This

means that, last batch of materials that come into store should

be issued out before the first batch.

The principle behind this method is that the price paid per unit for the last supply will be charged to the materials issued next to production.

(c)(i) FIFO Method